Standardized Input Consistent Output Flexible Process

Standardized Input

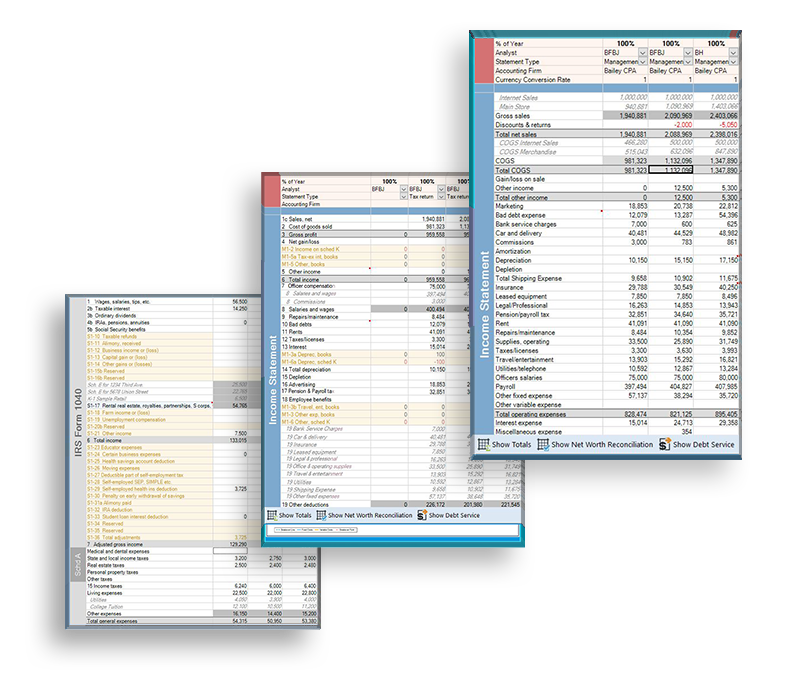

Easy data entry in familiar spreadsheet templates for tax returns and financial statements

FISCAL comes with intuitive financial statement templates for business, personal and CRE deals. From templates pre-set with a standard chart of accounts to tax returns mapped line by line to the IRS forms, our financial spreading software reduces time spent modifying Excel spreadsheets and formulas. Add Sub accounts and Schedules with just a few clicks.

From your first deal in FISCAL SPREADING, our simplified data entry gets you to financial analysis quickly, so your time is focused on the things that matter, and not on endlessly modifying your financial statement spreading templates.

Convenient templates for spreading financial statements

FISCAL eliminates the headache of spreading financials in Excel. Borrower submitted financials vary widely, including informal management statements, accountant prepared documents, and tax returns of every kind. But good analysis requires a standardized approach to small business lending.

Many smaller banks and credit unions try to accomplish standardization by creating their own templates in Excel, but juggling multiple templates is impractical and increases the risk of errors creeping in. However, forcing the infinite variety of real-world financials into any single chart of accounts is next to impossible — people find it takes too long, is too difficult, and might actually be Slowing Down their Efficiency.

FISCAL delivers the best of both worlds by providing templates for every common tax return and financial statement, along with easy options to convert into General Business format or send directly to FISCAL’s reporting tool for consistent outputs, while maintaining a high degree of flexibility.

FISCAL takes the guesswork out of spreading financial statements.

Streamlined process for efficient spreading

FISCAL’s built-in functionality makes it easy to do what you want to do. Add Columns, Detail Rows or New Rows, and Re-order them to match the documents you’re working from, Annualize statements, and calculate Average, Trailing Twelve Month, and Straight-line Projection statements with just a few clicks!

Small Business lending means spreading lots of tax returns, and FISCAL has templates mapped line-by-line to the tax returns, updated as needed to accommodate any changes to the forms. Whether you’re working from an 1120S, 1065, 8825, 1040, or a Schedule C or E, FISCAL provides out of the box templates that mirror your returns.

FISCAL gives you control. Unlike competitors, our financial spreading software lets your analysis be as detailed or abbreviated as the deal requires. For example, when considering a Loan Request, you can create a full Proposed Loan record to incorporate into Global Cash Flow, Debt Service Coverage, and Credit Memo reports, or simply enter the estimated debt service into the DS Adjustments field as a first look or pre-flight analysis.

With FISCAL you have exactly what you need for every scenario.

Eliminate manual data entry

Our Core Import utility can pull information into FISCAL directly from your core system for Borrowers and Guarantors, along with general demographic information and existing Loan and Deposit relationships. Update existing deals and create new records automatically, all without a single manual keystroke.

FISCAL’s Credit Memo auto-populates this information into your write ups, along with the financial spread data you have already entered, so 90% of the work is done for you, knocking hours off the process.

With many options to automate mindless, time-consuming tasks, FISCAL allows your analysts to focus their energy on reviewing what happened, determining why it happened, and making necessary adjustments, modifications, or notations, without wasting their valuable time.

FISCAL keeps your resources focused on your priorities.

WATCH A VIDEO DEMO OF OUR FINANCIAL SPREADING SOFTWARE

See FISCAL Forward’s features for yourself.

Consistent Output

Clear, concise presentation and credit analysis in easy-to-read, one-page reports

Eliminate confusion and frustration when dealing with inconsistent Excel– and Word-based reports where order, format and content of financial statements vary from person to person. Our summary reports highlight key information for decision-makers, while finely-tuned expanded versions offer clean, logical layouts, so anyone can quickly recognize and assess important details.

Report options can be easily saved and changed, producing predictable reports focused on your credit analysis priorities.

Easy to read, one page reports

FISCAL’s reports deliver in-depth, standardized credit analysis, providing Year over Year Change and Common Size columns immediately beside the actual-dollar values. Choose from more than 50 available ratios, highlighting what matters most to you. Financial data and Ratios can be compared to industry benchmarks from the RMA Annual Statement Studies with the click of a button.

Our clear, concise report design makes it easy to see and understand trends, to make useful comparisons, and to present a comprehensive analysis formatted for executive review. From Global Cash Flow to Credit Memos, FISCAL reports target exactly the information you want to see, whether you’re looking for a summary or really want to dig into the details.

FISCAL reports are clean, concise, and focused.

Consistency is key

FISCAL’s reports also standardize the format of your credit analysis: no more font or style changes in the middle of your credit packages. FISCAL reports present your financial statement analysis in an intuitive format, with consistent header, footer, and column information, giving you a dependable layout from deal to deal and analyst to analyst.

Your Loan Committee will love getting the information they need, exactly where they expect it to be, so that they don’t have to spend valuable time searching through presentations from front to back, looking for a specific value or ratio. FISCAL’s Report Sets, Selected Ratios for Reports, and Credit Memo templates ensure that you get the same information, in the same order, with the same options and settings, every single time.

FISCAL gives you just what you want, right where you expect it to be.

Keep it Transparent

FISCAL knows it’s not enough just to get the right answer, you need to understand where the number came from and be able to explain it to someone else. Unlike some financial statement analysis software, FISCAL reports maintain complete transparency with the Spreads you entered- no indecipherable summaries, assumptions, or estimates made without your knowledge.

FISCAL gives you complete control, whether it’s making adjustments to a Tax Return, discounting cash flow for a guarantor or related entity, or making deal-specific edits to a Credit Memo. Add footnotes to reports from within the Spreads, Proposed Loan, or at report runtime to explain your entries.

FISCAL offers clarity and control at every step: spreads, calcs, and reports.

Flexible Process

Quick, convenient adjustments with built-in capacity to capture real-world scenarios

Avoid the headache of rigid financial spreading software systems intended for large banks with large borrowers submitting audited financials. Our spreads accommodate the reality that tax returns may not accurately reflect cash flow, so you can adjust it directly and substitute CPLTD with Debt Service entries. Responsive Global Cash Flow options let you include multiple businesses, people and loans in a deal.

We understand how small community banks and credit unions work, so our credit analysis software tools keep you focused on getting the job done.

Do what YOU do. Better, faster, and more easily with our financial spreading software.

Use only what you Need

We understand what you’re looking for on a deal – positive cash flow. That’s why FISCAL lets you jump straight into the Spreads and on to reports. Once you’re confident the deal makes sense, come back and create your Customer, fleshing out the rest of the background information.

Small community banks and credit unions don’t turn borrowers away just because their loan request is small, but simple deals shouldn’t require the same level of detailed analysis as your largest and most complex relationships. FISCAL’s spread templates let you run a cash flow with as little entered as Sales, Total Expenses, Addbacks, and Total Debt Service.

FISCAL gives you powerful tools to dig into detail where it matters, and the flexibility to summarize the rest.

Adjust Away

FISCAL understands that when it comes to Small Business lending, using the information exactly as it appears on the Tax Return or management-prepared financials doesn’t always tell the whole story. Built-in templates get you started, with the ability to Add Columns, Detail Rows or New Rows, and Re-order them to match the documents you’re working from, Annualize statements, and calculate Average, Trailing Twelve Month, and Straight-line Projection statements with just a few clicks! Hide Rows, rename, and repurpose accounts on the fly for anything you don’t need.

Whether combining two years of Tax Returns with the most-recent P&L or creating a TTM or Average calculated column, FISCAL does all the work for you. But once the information is in the Spread, you can still adjust it as you see fit- you’re in the driver’s seat.

FISCAL balances automation with flexibility, without forcing decisions on you.

Not locked Down

For Small Business lenders, it’s not uncommon to see borrower financials with all sorts of problems. With FISCAL, you don’t have to balance the Balance Sheet or eliminate Unexplained NW Variation. Outage rows alert you to irregularities, but we don’t force you to make arbitrary changes to the financials, just to get things to balance.

When it comes to Global Cash Flow, the possible scenarios are nearly endless. Should you include minor owners or related entities? Discount cash flow based on ownership? Use EBITDA or UCA NCAO? The answer may change from deal to deal, and choosing the best approach should be up to you.

With FISCAL, you can tailor each scenario to be just what you need.

FISCAL Forward Features

Global Cash Flow

- Multiple Businesses

- Multiple People

- Multiple Loans

- Flexible Calculation Options

Business and Personal Spreads

- Tax Returns

- Annual or Interim Financial Statements

- Projections

- Trailing Twelves

20+ Standard Reports

- Executive Summary

- Detailed Analysis

- One-click Narrative

- RMA Benchmark Comparisons

- 300+ unique graphs and charts

Credit Memos

- Fully-editable in Microsoft Word

- Highly customizable

- Use multiple memo templates for different purposes

CRE Sensitivity

- Stress Tests by Vacancy, Interest and Capitalization Rates

- Rent Rolls

- DSCR & LTV Sensitivity

Our Tools Work the Way You Work.

Still have questions? Let’s talk.

Call 800.248.5550

or

Fill out the form below: